Pie Chart of ADFs of all Runs by Grade and some more advice.

Amazingly Secret Approach Using an Incredibly Novel Data Analysis Procedure for Comic Book Investing and Speculation.

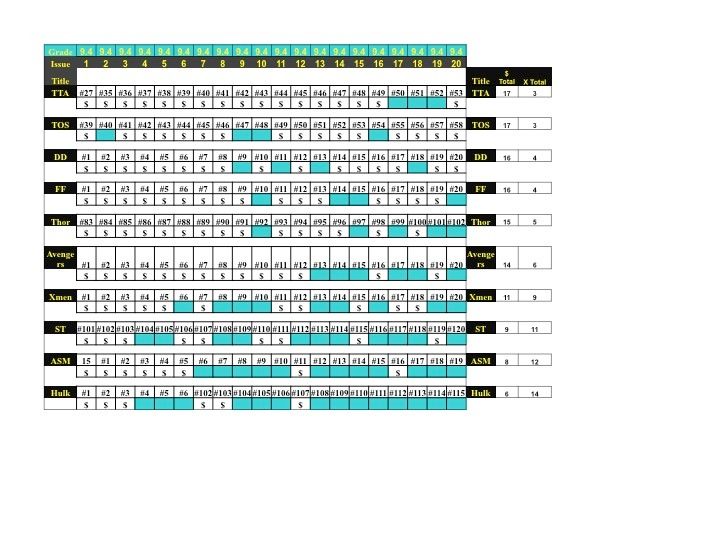

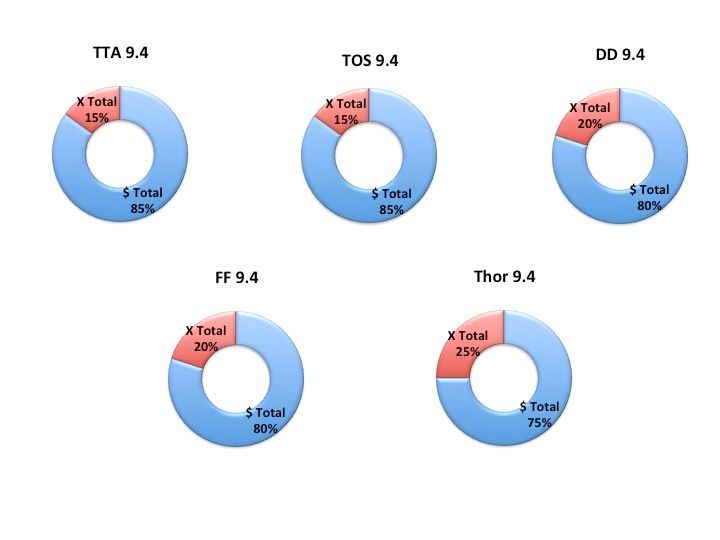

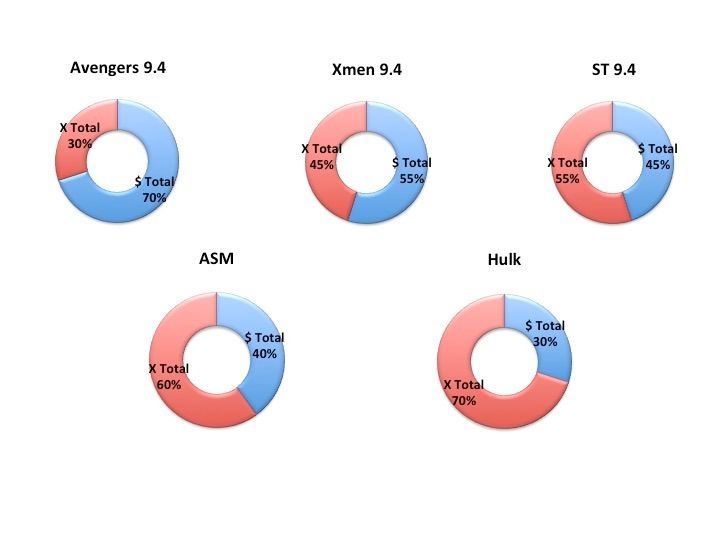

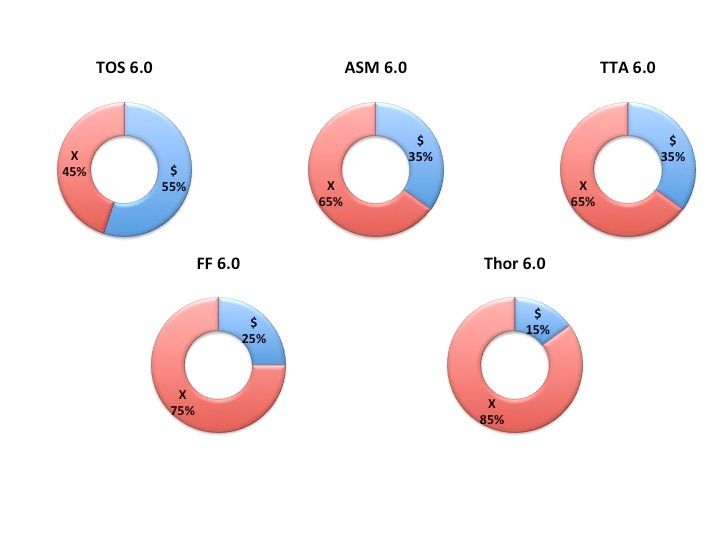

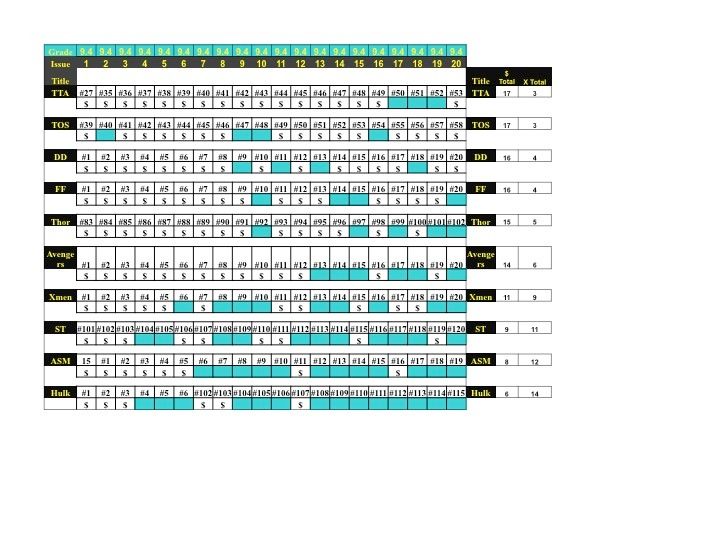

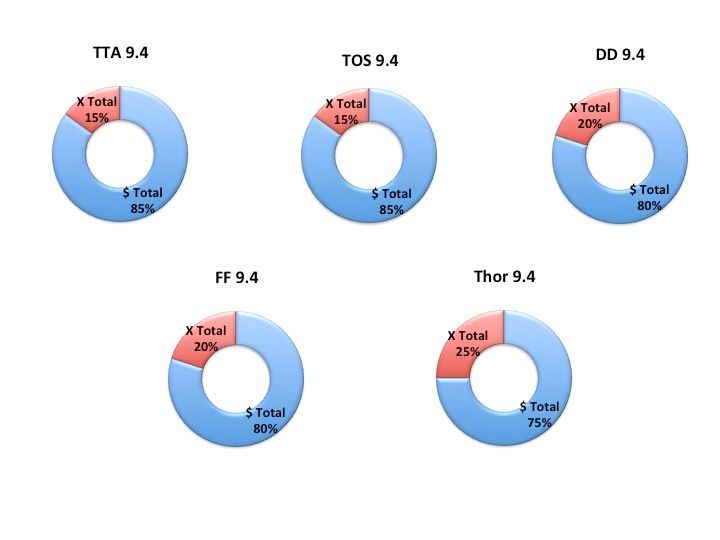

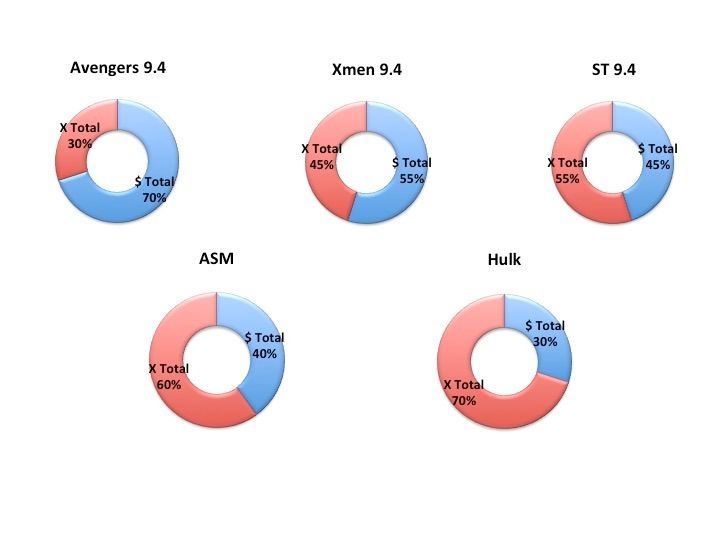

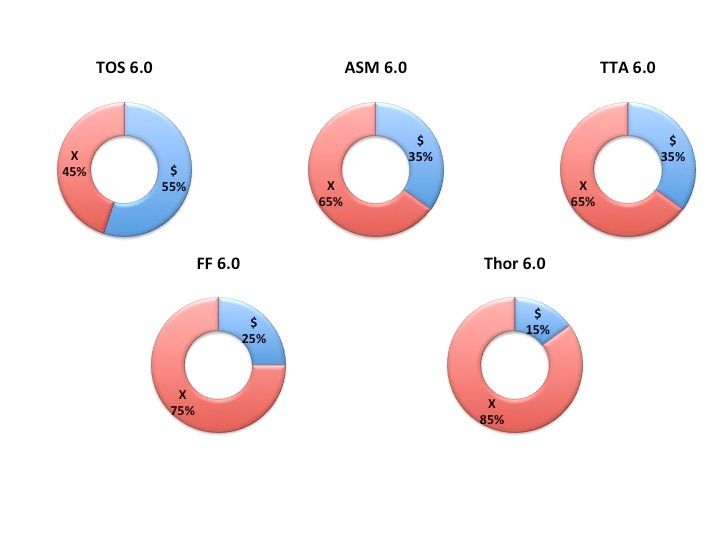

This post is just part 1 of a wrap up of the runs we have looked into. I like to have a Top-Down view of the runs. I have listed a tabular view of the first 20 issues/run at 9.4, 8 and 6. Followed by the Individual Pie Charts of each run's ADFs at each grade. Note I placed the table and pie chart in order from highest % of issues denoted as $ for Insiders Biased. The blue green color denoted Outsider Biased Issues.

Note the $ % range at 9.4 was 85% to 30%, at 8.0 it was from 50% to 0% and 6.0 was 55% to 5%. So I am going to assume these kind of numbers exist for all major runs in silver-age books. That my hypothesis anyway. Given the rarity of the 9.4 issues you could expect this result.

I wonder with moderns if they show the same pattern not because of rarity but because we now have serious collectors buying and holding issues off the shelves. That population is very high as compared to the 1960s. A modern comic in a 8.0 or 6.0 grade must be worth next to nothing? So for the future when did that transition start? in the 1970s? 80s? I would guess 1976 because the Overstreet price guide went national at that point. I remember in 1975 my local used book store moved collectible comic-books to under the counter and charged more money using the 1975 price guide. Before that time they were in piles and boxes unsorted. It was a great time to be a collector in 1973-4! YES I SHOULD HAVE BOUGHT EVERYTHING! I DID NOT!

Ok so the take home is that when you are hanging in the 9.4 grade you have an excellent chance of landing on a solid investment. On the other hand the range of the 8 and 6 is nearly the same. I was surprised. I would have thought the 8 grade range might have looked like 60 to 20 or so. Then the grade 6 would make more sense. So is grade 8 in these runs overdone? Will the next group of 10 or so show this pattern?. So I am thinking that one slice of your bankroll may be to get into a run at a mix of 9.4 and 6.0 and leave the 8 grades out. So hit the High I at each level in a run? Build cash up buy selling the 6.0s after the right time and plow back into 9.4s. Your money management has to be considered as well. Some investors think money management is most of the battle? How much to invest per run per issue per grade? If you have a bankroll of 100$ what ya going do? Not much. I suggest flipping enough O biased issues to build a roll up. 10K would be nice? My bankroll in my 2013 year was 5000$. That the lowest I will go. I am moving back into building again. Selling and building.

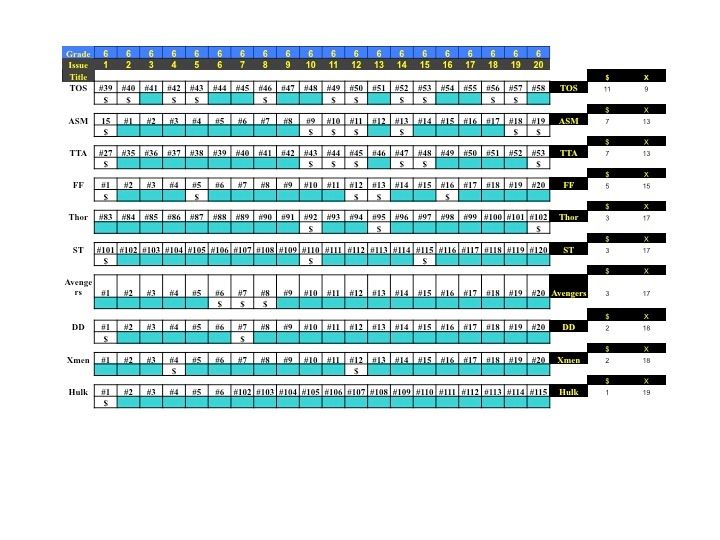

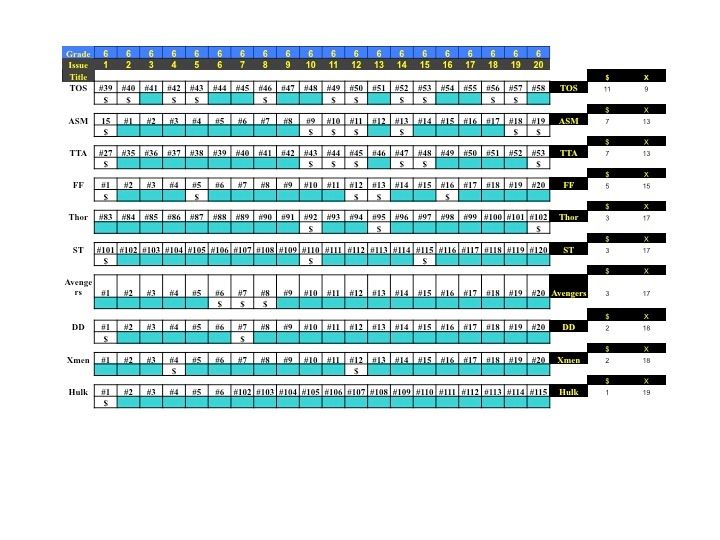

Table 1 All issues at 9.4

Table 1 analysis show the high variation in these runs. See the Pie Charts below, Why is TTA and TOS are the top and Hulk and ASM at the bottom? 85% to 40% ish. Double the difference. If the market was efficient would we see this? Another trick I do is the plot the avg price and place the I-Biased issues that are in that area underneath. So you now have the budget and the books to target. So you can have a buy order in an auction or convention of say 400$ so then you could search out in your group which one you can get for close to your price. You can go to a dealer and have more flexibility.

Table 1 analysis show the high variation in these runs. See the Pie Charts below, Why is TTA and TOS are the top and Hulk and ASM at the bottom? 85% to 40% ish. Double the difference. If the market was efficient would we see this? Another trick I do is the plot the avg price and place the I-Biased issues that are in that area underneath. So you now have the budget and the books to target. So you can have a buy order in an auction or convention of say 400$ so then you could search out in your group which one you can get for close to your price. You can go to a dealer and have more flexibility.

The opposite approach is costly. Here's the story then. You walk into a convention floor and the dealer sees a potential buyer and ask what ya like? Uh you say ASM 14 and he has one and you begin to deal. You are playing a losing hand. He knows ya want it so he can play you and figures he can hang tough with you. Try this instead say "I am looking to get a good deal for my 400$ for ASM 14, FF 12, Xmen 4 DD7 etc." List about 10. Then see what happens. You have a better hand because you have named so many that he can see you moving on to others that could have those issues. You have a budget and can easily stick to it. You are not locked in to anything. If you bias yourself then you lose. I got to have that book cause it hot, its a movie, its pretty etc.

Last thing. Get yourself say 400$ (don't get mugged haha) and walk in and pull it out and count it. Then spend the rest of the day not buying anything. If you can walk out and away from temptation then you have a shot at making this work!

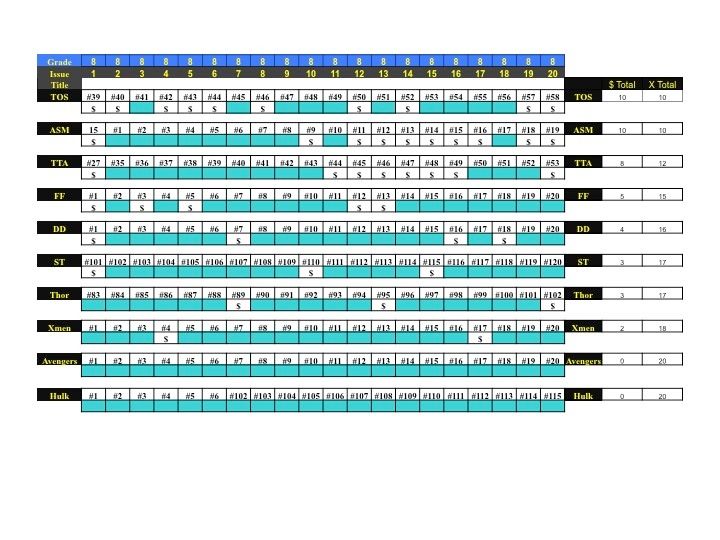

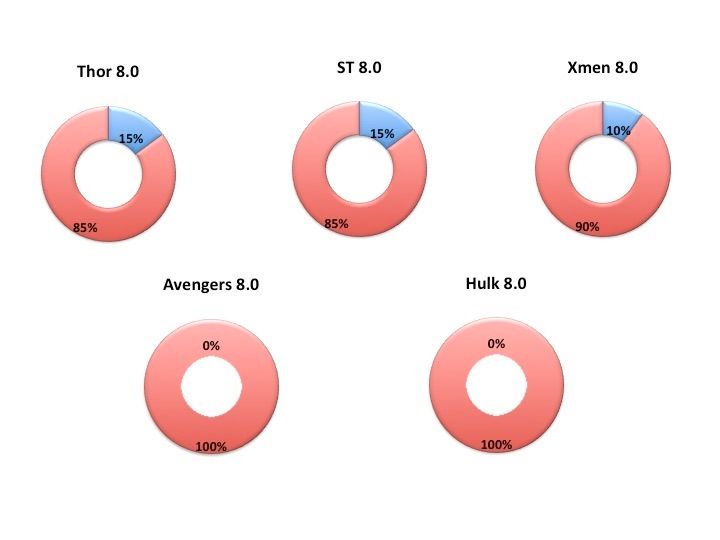

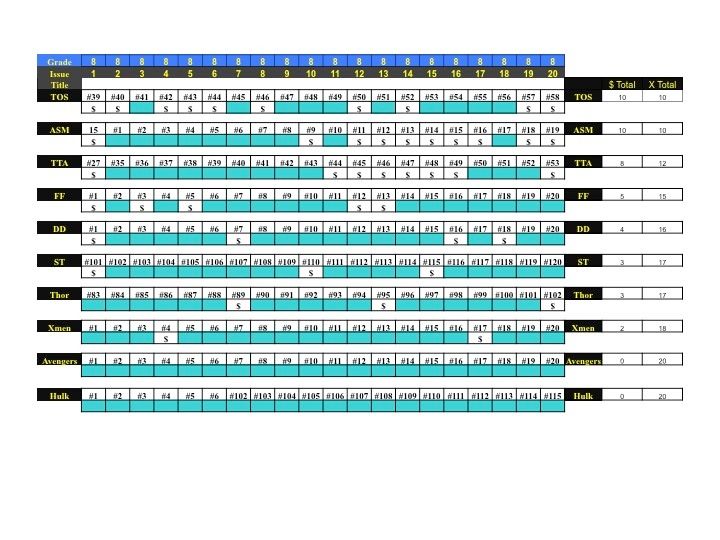

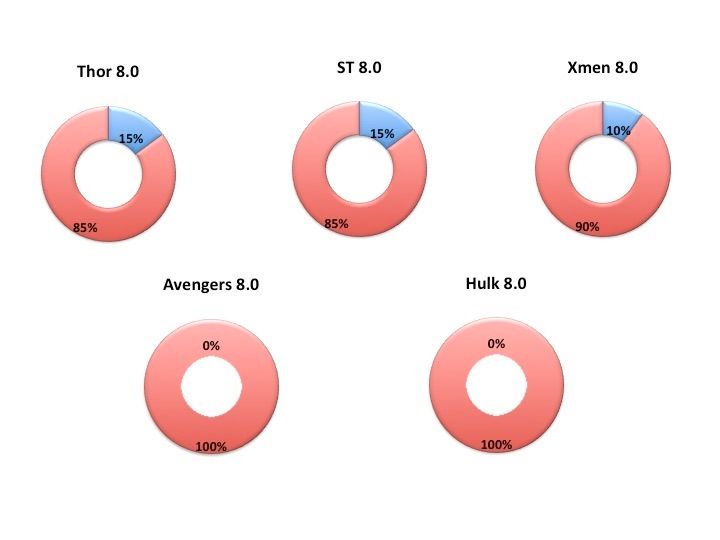

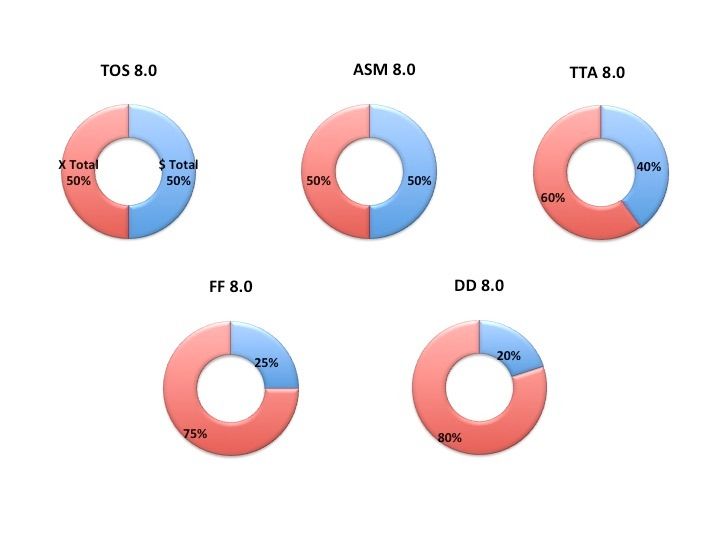

Table 2 All issues at 8.0

So looking at Table 2, I was surprised at the range of the data (see the Pie Charts below). The range is 50% to 0% I-Biased. I would not have predicted that. Clearly you must exercise caution in your buying selection below 9.4. By the way what is the range at 8.5 or 9.0? I have not swim in those world yet. Easy to eliminate runs all together in your investments in this grade. So this data my save you money by "telling" you not to buy an issue. Notice ASM moves up to the 2nd spot from last at grade 9.4. More variation! Market efficient? So could you speculate that ASM at 9.4 is overbought but not at 8.0 So is that is plan for your ASM investments. Is there more room for your investment "upside" Hey Now! Are these issue your overlays? Note the others in the top 5 are nearly the same. So these are more steady? Is steady good?

We will see as well have more time to view these runs next year as we will revisit these questions.

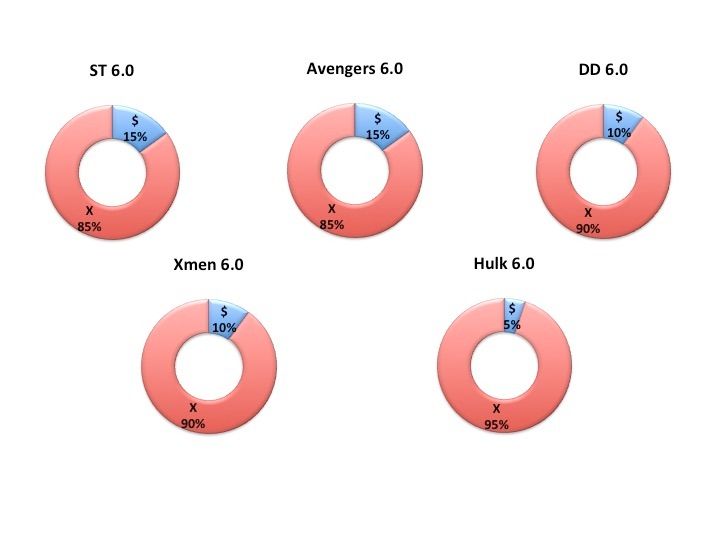

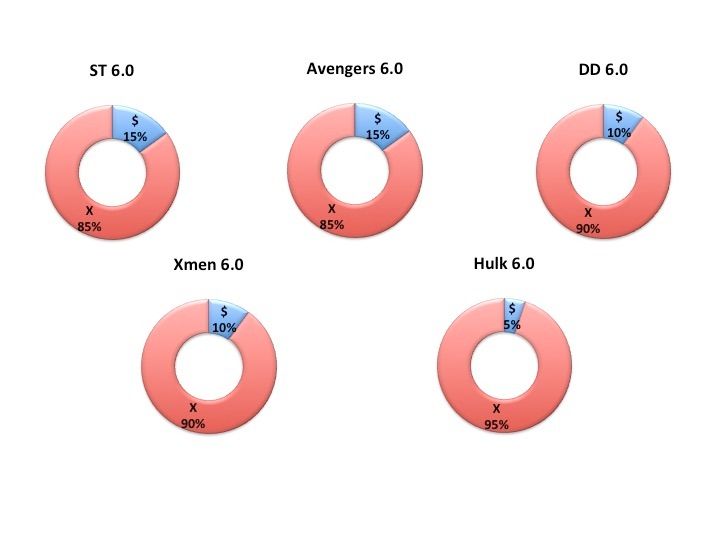

Table 2 All issues at 6.0

Table 2 All issues at 6.0

Analysis of the data in Table 3 and Pie Charts suggest that ASM is under-bought relative to the 9.4 issues and the TOS should be consider the top issue for your focus. It is high across the grade. So I would think about a plan to dig deep into TOS at all grades here and ASM at 8 and 6 only. So combine your bankroll skills, negotiation skills and angles use to buy with and go for it. Remember only use excess capital not living in a hut and getting beans so you can buy TOS 52.

Last thing if you go to a convention slow browse and see if you can catch a deal going down. Watch the dealer and buyer. See the mistakes. See if that was a good deal or not. Was the dealer ready to sell? Size up the situation before you swoop in for you bargain.

"If you’re at a poker table and you don’t see a sucker, it’s you.” This gambling saying dates to at least 1982 and was possibly coined by Amarillo Slim Preston, a professional gambler.

“Let your plans be dark and impenetrable as night, and when you move, fall like a thunderbolt.” ― Sun Tzu, The Art of War

Good Luck!

This post is just part 1 of a wrap up of the runs we have looked into. I like to have a Top-Down view of the runs. I have listed a tabular view of the first 20 issues/run at 9.4, 8 and 6. Followed by the Individual Pie Charts of each run's ADFs at each grade. Note I placed the table and pie chart in order from highest % of issues denoted as $ for Insiders Biased. The blue green color denoted Outsider Biased Issues.

Note the $ % range at 9.4 was 85% to 30%, at 8.0 it was from 50% to 0% and 6.0 was 55% to 5%. So I am going to assume these kind of numbers exist for all major runs in silver-age books. That my hypothesis anyway. Given the rarity of the 9.4 issues you could expect this result.

I wonder with moderns if they show the same pattern not because of rarity but because we now have serious collectors buying and holding issues off the shelves. That population is very high as compared to the 1960s. A modern comic in a 8.0 or 6.0 grade must be worth next to nothing? So for the future when did that transition start? in the 1970s? 80s? I would guess 1976 because the Overstreet price guide went national at that point. I remember in 1975 my local used book store moved collectible comic-books to under the counter and charged more money using the 1975 price guide. Before that time they were in piles and boxes unsorted. It was a great time to be a collector in 1973-4! YES I SHOULD HAVE BOUGHT EVERYTHING! I DID NOT!

Ok so the take home is that when you are hanging in the 9.4 grade you have an excellent chance of landing on a solid investment. On the other hand the range of the 8 and 6 is nearly the same. I was surprised. I would have thought the 8 grade range might have looked like 60 to 20 or so. Then the grade 6 would make more sense. So is grade 8 in these runs overdone? Will the next group of 10 or so show this pattern?. So I am thinking that one slice of your bankroll may be to get into a run at a mix of 9.4 and 6.0 and leave the 8 grades out. So hit the High I at each level in a run? Build cash up buy selling the 6.0s after the right time and plow back into 9.4s. Your money management has to be considered as well. Some investors think money management is most of the battle? How much to invest per run per issue per grade? If you have a bankroll of 100$ what ya going do? Not much. I suggest flipping enough O biased issues to build a roll up. 10K would be nice? My bankroll in my 2013 year was 5000$. That the lowest I will go. I am moving back into building again. Selling and building.

Table 1 All issues at 9.4

Table 1 analysis show the high variation in these runs. See the Pie Charts below, Why is TTA and TOS are the top and Hulk and ASM at the bottom? 85% to 40% ish. Double the difference. If the market was efficient would we see this? Another trick I do is the plot the avg price and place the I-Biased issues that are in that area underneath. So you now have the budget and the books to target. So you can have a buy order in an auction or convention of say 400$ so then you could search out in your group which one you can get for close to your price. You can go to a dealer and have more flexibility.

Table 1 analysis show the high variation in these runs. See the Pie Charts below, Why is TTA and TOS are the top and Hulk and ASM at the bottom? 85% to 40% ish. Double the difference. If the market was efficient would we see this? Another trick I do is the plot the avg price and place the I-Biased issues that are in that area underneath. So you now have the budget and the books to target. So you can have a buy order in an auction or convention of say 400$ so then you could search out in your group which one you can get for close to your price. You can go to a dealer and have more flexibility.The opposite approach is costly. Here's the story then. You walk into a convention floor and the dealer sees a potential buyer and ask what ya like? Uh you say ASM 14 and he has one and you begin to deal. You are playing a losing hand. He knows ya want it so he can play you and figures he can hang tough with you. Try this instead say "I am looking to get a good deal for my 400$ for ASM 14, FF 12, Xmen 4 DD7 etc." List about 10. Then see what happens. You have a better hand because you have named so many that he can see you moving on to others that could have those issues. You have a budget and can easily stick to it. You are not locked in to anything. If you bias yourself then you lose. I got to have that book cause it hot, its a movie, its pretty etc.

Last thing. Get yourself say 400$ (don't get mugged haha) and walk in and pull it out and count it. Then spend the rest of the day not buying anything. If you can walk out and away from temptation then you have a shot at making this work!

Table 2 All issues at 8.0

So looking at Table 2, I was surprised at the range of the data (see the Pie Charts below). The range is 50% to 0% I-Biased. I would not have predicted that. Clearly you must exercise caution in your buying selection below 9.4. By the way what is the range at 8.5 or 9.0? I have not swim in those world yet. Easy to eliminate runs all together in your investments in this grade. So this data my save you money by "telling" you not to buy an issue. Notice ASM moves up to the 2nd spot from last at grade 9.4. More variation! Market efficient? So could you speculate that ASM at 9.4 is overbought but not at 8.0 So is that is plan for your ASM investments. Is there more room for your investment "upside" Hey Now! Are these issue your overlays? Note the others in the top 5 are nearly the same. So these are more steady? Is steady good?

We will see as well have more time to view these runs next year as we will revisit these questions.

Table 2 All issues at 6.0

Table 2 All issues at 6.0

Analysis of the data in Table 3 and Pie Charts suggest that ASM is under-bought relative to the 9.4 issues and the TOS should be consider the top issue for your focus. It is high across the grade. So I would think about a plan to dig deep into TOS at all grades here and ASM at 8 and 6 only. So combine your bankroll skills, negotiation skills and angles use to buy with and go for it. Remember only use excess capital not living in a hut and getting beans so you can buy TOS 52.

Last thing if you go to a convention slow browse and see if you can catch a deal going down. Watch the dealer and buyer. See the mistakes. See if that was a good deal or not. Was the dealer ready to sell? Size up the situation before you swoop in for you bargain.

"If you’re at a poker table and you don’t see a sucker, it’s you.” This gambling saying dates to at least 1982 and was possibly coined by Amarillo Slim Preston, a professional gambler.

“Let your plans be dark and impenetrable as night, and when you move, fall like a thunderbolt.” ― Sun Tzu, The Art of War

Good Luck!

Comments

Post a Comment