Investment Potential and Bias of Tomb of Dracula Analysis Issues #1 to 17

Amazingly Secret Approach Using an Incredibly Novel Data Analysis Procedure for Comic Book Investing and Speculation.

Tomb of Dracula Analysis Issues #1 to 17

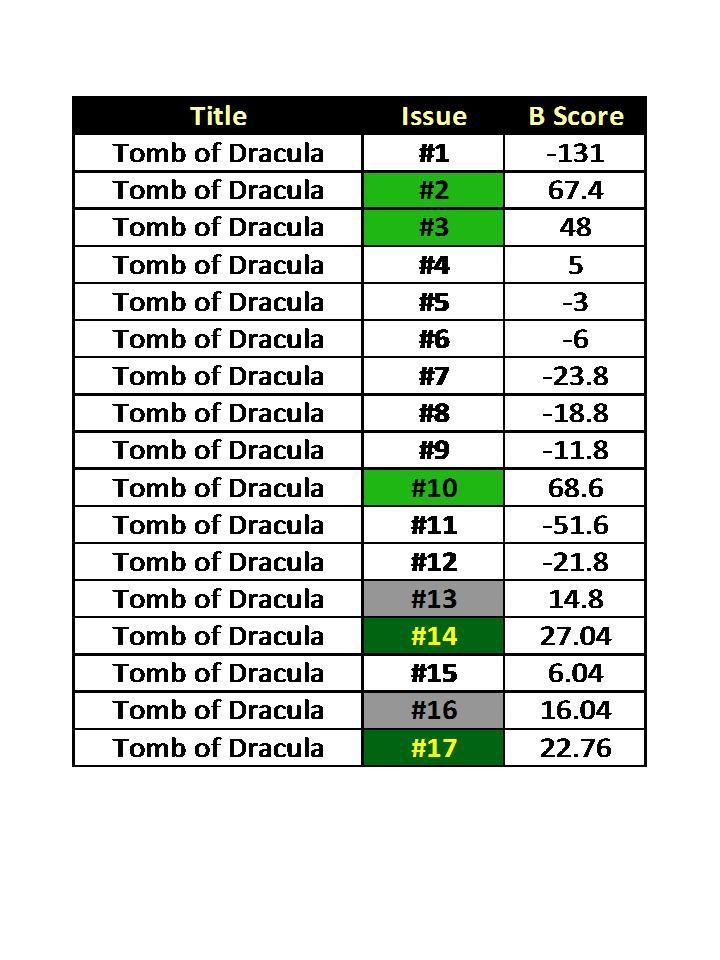

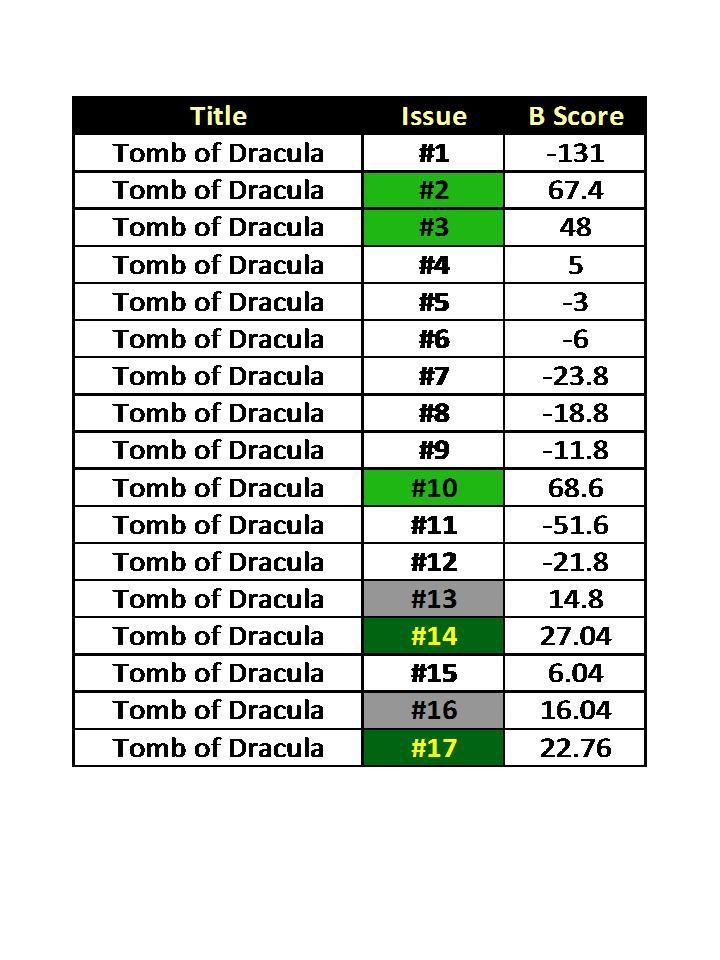

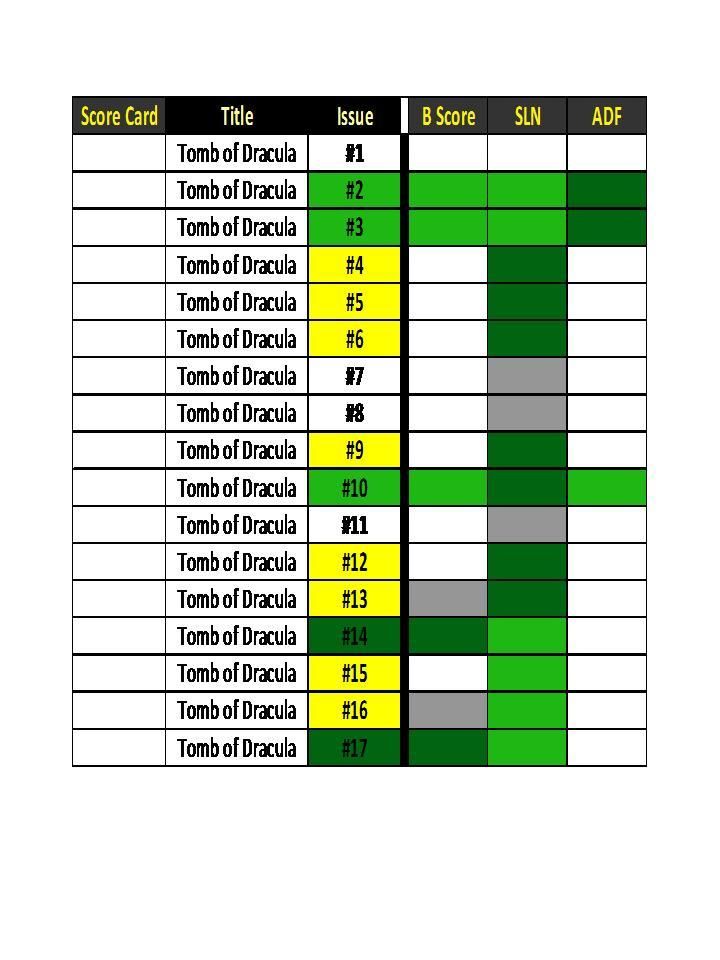

In the bronze era we have the publishing of horror based heroes? This is a major one of that group. I start out look at the first 1 to 17 issues. I have listed the Bias Scores and denoted by colorization the issues of high Bias, Lime Green and Dark Green issues that are somewhat Biased. grey staining are issues on the watch list.

There are 3 issues in Table 1 that are Lime Green stained. Issues 2, 3 and 10. Issue 2 and 3 are early but are not overbought as is Issue 1. Issue 3 is the first appearance of Rachel van Helsing and Taj Nitall. Issue 10 is the first appearance of Blade (Eric Brooks). I would focus on these issues. Also issue #14 and 17 are somewhat Biased. Issue 14 Dracula dies by Blades hand and comes back. Issue 17 is a continuation of Dr Sun and his work.

Table 1. Bias of TOD 1 to 17 Issues.

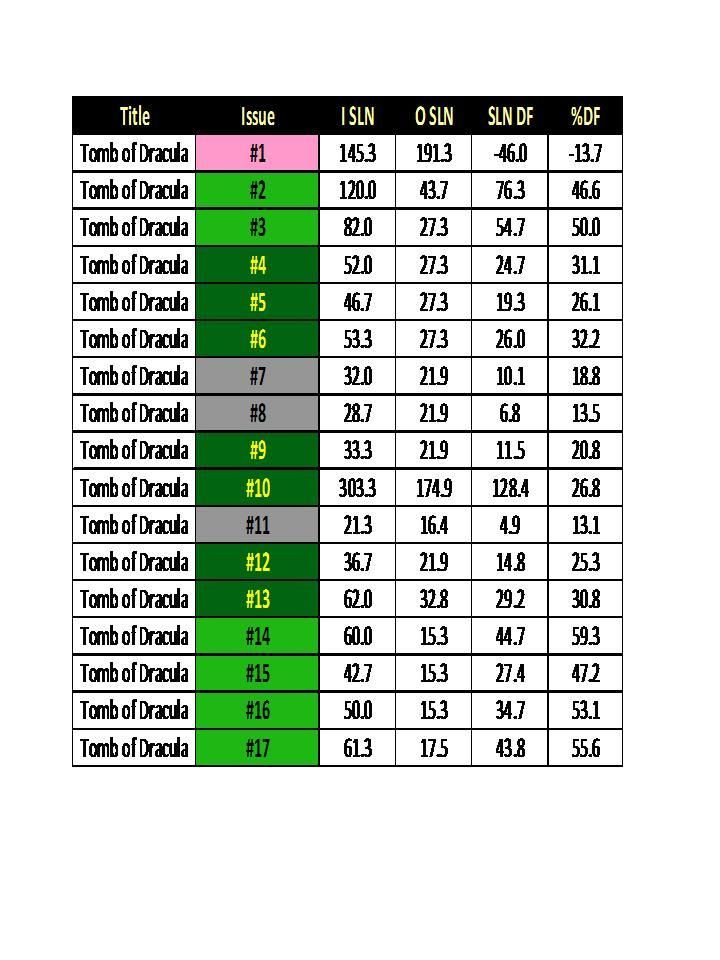

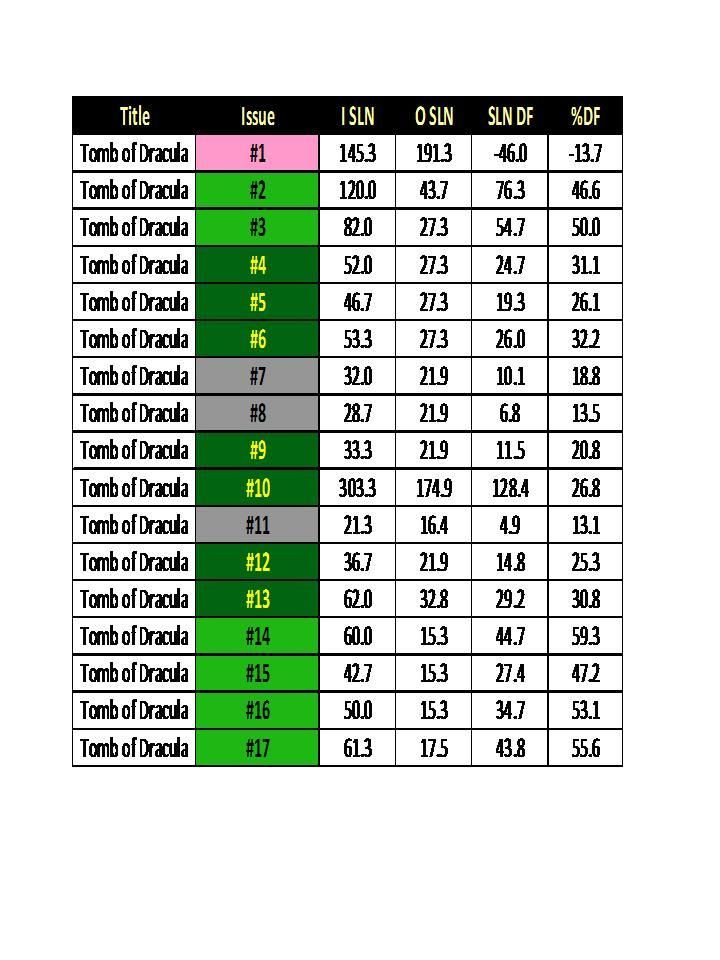

In Table 2, I have displayed the SLN, SLN DF and %DF numbers of these issues. Lime green issues are the highest biased and dark green are issues that are somewhat biased. Note Issue 1 continues to give us data that it is overbought by the Outsiders vs the Insiders. We see Issue 2 and 3 as well as 14 to 17 are highlighted as High Biased issues. The DF number compare both I and O worlds and the highest

Table 2. SLN, DF and DF% of TOD 1 to 17

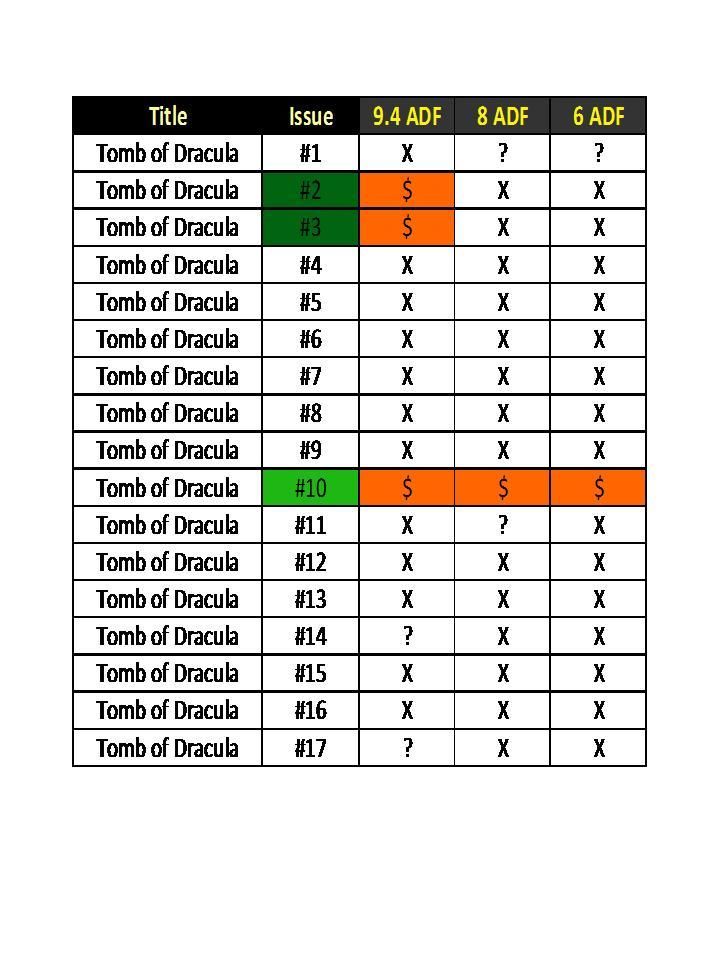

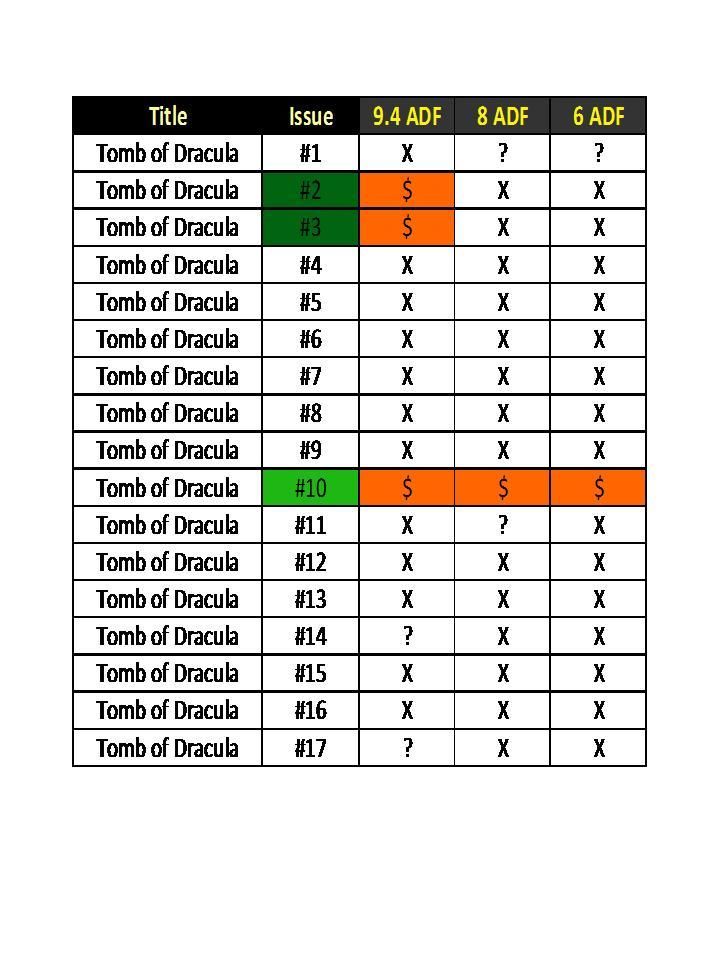

The deepest level we do is the ADFs data that compared the I and O worlds at each grade. Orange $ are data points that are biased. If issues are biased by the Insiders at all grades 9.4 8 and 6, they are stained Lime Green. Issues biased at the 9.4 level only are colorized by dark green. We see Issue 10 is the only issue that is Biased across the board. I recommend to focus on for investment purposes. Note issues 2 and 3 are only to be focused on at the 9.4 level. Avoid the other issues.

Table 3. ADFs of the TOD Issues 1 to 17.

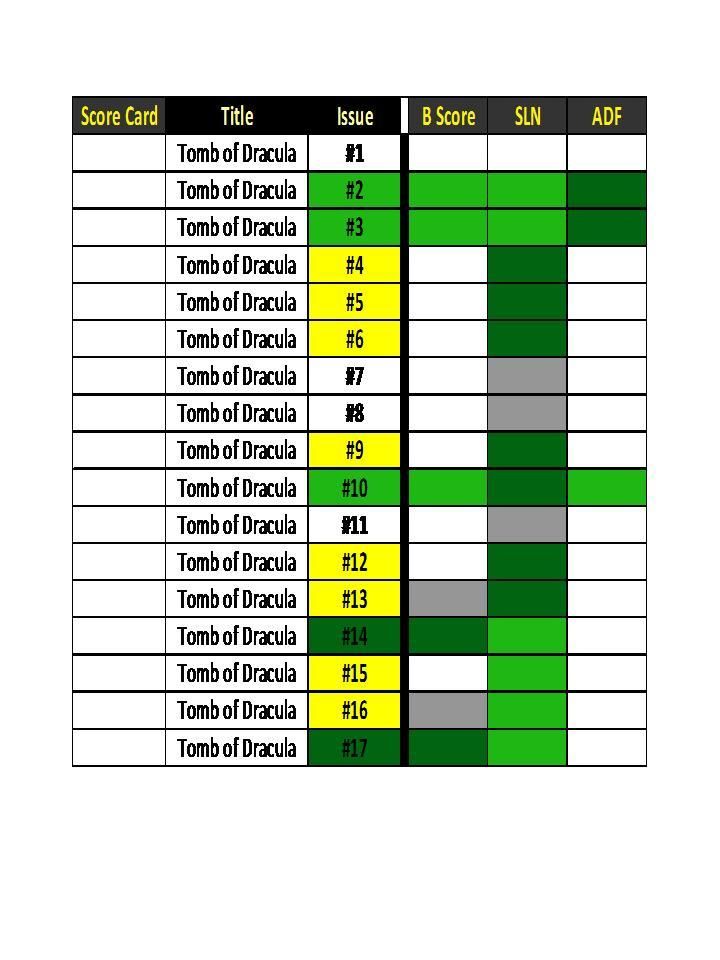

In Table 4, I give the landscape view of this Title and issue run. We see that Issues 2, 3 and 10 are the show and those issues are where our main attention my be. the ADF data seems to eliminate issue 14 and 17 and illustrated the value of Issue 10.

Table 4. Landscape view of TOD Issues 1 to 17.

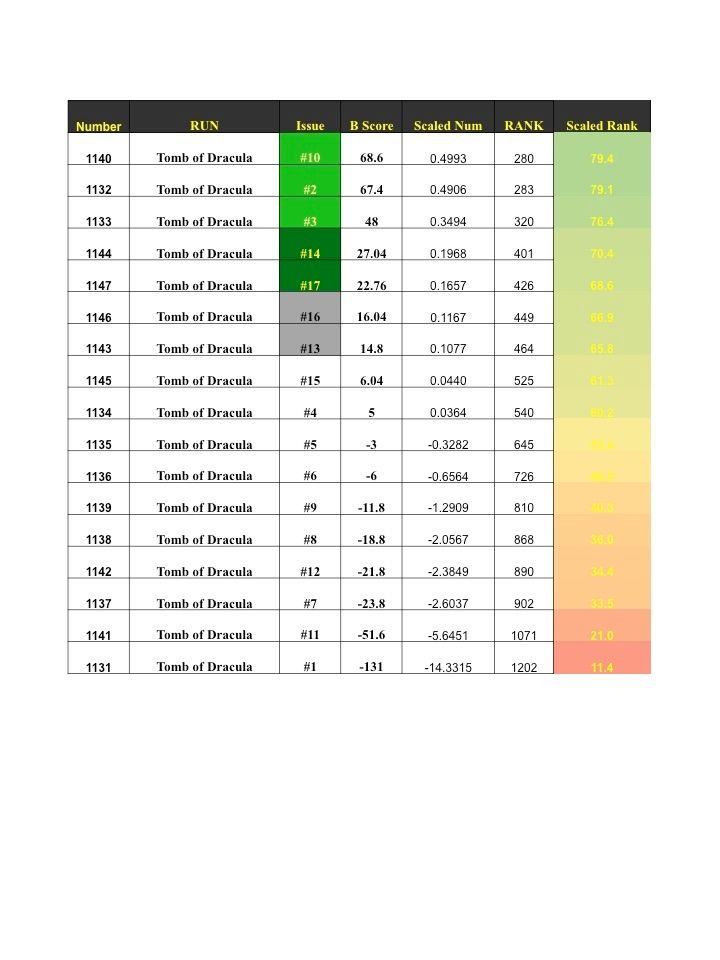

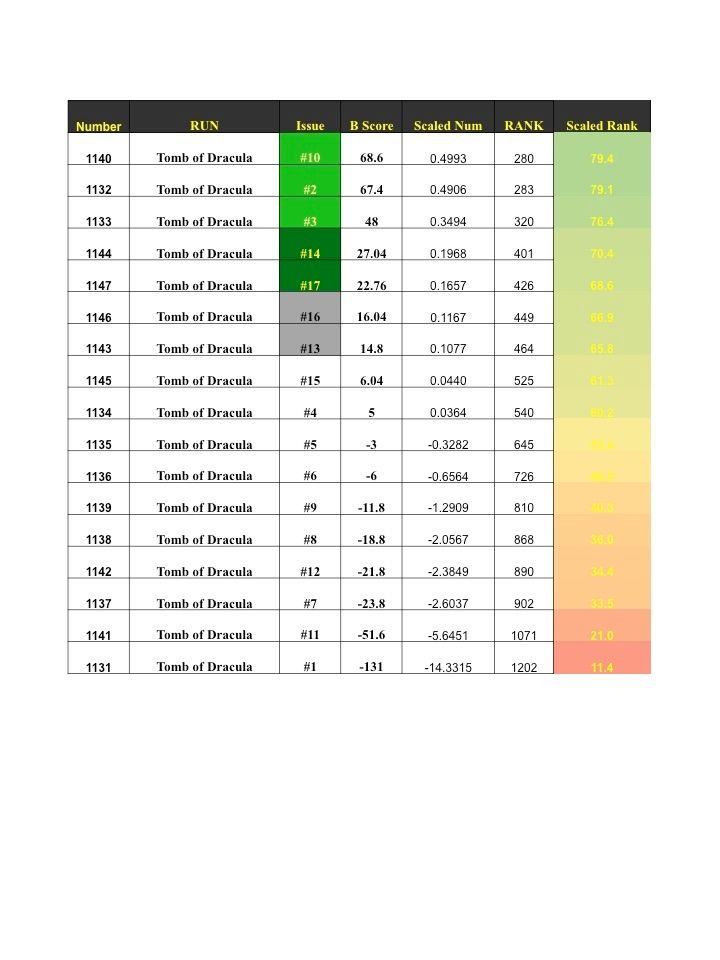

Table 5 highlight the Desire scale for all analyzed issues and a scaled rank number is a key piece.

We see the top 3 issues are 10, 2 and 3 ranked in the top 25 percentile level. Note Issue 1 at the 10% level. That is surprising and shows the over buying of that issue by the outsiders. Its a sell for me. I am bullish on Issue 10, 2 and 3.

Table 5. Scaled Ranking of TOD Issues 1 to 17

Tomb of Dracula Analysis Issues #1 to 17

In the bronze era we have the publishing of horror based heroes? This is a major one of that group. I start out look at the first 1 to 17 issues. I have listed the Bias Scores and denoted by colorization the issues of high Bias, Lime Green and Dark Green issues that are somewhat Biased. grey staining are issues on the watch list.

There are 3 issues in Table 1 that are Lime Green stained. Issues 2, 3 and 10. Issue 2 and 3 are early but are not overbought as is Issue 1. Issue 3 is the first appearance of Rachel van Helsing and Taj Nitall. Issue 10 is the first appearance of Blade (Eric Brooks). I would focus on these issues. Also issue #14 and 17 are somewhat Biased. Issue 14 Dracula dies by Blades hand and comes back. Issue 17 is a continuation of Dr Sun and his work.

Table 1. Bias of TOD 1 to 17 Issues.

In Table 2, I have displayed the SLN, SLN DF and %DF numbers of these issues. Lime green issues are the highest biased and dark green are issues that are somewhat biased. Note Issue 1 continues to give us data that it is overbought by the Outsiders vs the Insiders. We see Issue 2 and 3 as well as 14 to 17 are highlighted as High Biased issues. The DF number compare both I and O worlds and the highest

Table 2. SLN, DF and DF% of TOD 1 to 17

The deepest level we do is the ADFs data that compared the I and O worlds at each grade. Orange $ are data points that are biased. If issues are biased by the Insiders at all grades 9.4 8 and 6, they are stained Lime Green. Issues biased at the 9.4 level only are colorized by dark green. We see Issue 10 is the only issue that is Biased across the board. I recommend to focus on for investment purposes. Note issues 2 and 3 are only to be focused on at the 9.4 level. Avoid the other issues.

Table 3. ADFs of the TOD Issues 1 to 17.

In Table 4, I give the landscape view of this Title and issue run. We see that Issues 2, 3 and 10 are the show and those issues are where our main attention my be. the ADF data seems to eliminate issue 14 and 17 and illustrated the value of Issue 10.

Table 4. Landscape view of TOD Issues 1 to 17.

Table 5 highlight the Desire scale for all analyzed issues and a scaled rank number is a key piece.

We see the top 3 issues are 10, 2 and 3 ranked in the top 25 percentile level. Note Issue 1 at the 10% level. That is surprising and shows the over buying of that issue by the outsiders. Its a sell for me. I am bullish on Issue 10, 2 and 3.

Table 5. Scaled Ranking of TOD Issues 1 to 17

Comments

Post a Comment